Per the Roger Cpa Exam Review What Does the Financial Reporting Framework Include?

CPA Test Changes

Each year, the AICPA approves various changes and updates to the CPA Examination, altering pre-existing sections, calculation new topics and occasionally removing older ones. Read through the timeline below to learn nearly the upcoming CPA Exam updates and subscribe to our newsletter to ensure you stay on meridian of all of the latest changes to the CPA Exam.

Read the 2021 CPA Blueprints

The CPA Exam Blueprints are created past the American Institute of Certified Public Accountants (AICPA) to help CPA candidates know what skills and content topics will be tested on the CPA Exam. Read the blueprints to know what y'all need to report!

Explore CPA Blueprints

2022 Changes | 2021 Changes | 2020 Changes | 2020 FAQ | 2019 Changes | 2019 FAQ

2022 CPA Exam Changes

The time is now. Take the first step towards CPA Exam success!

Every bit the accounting profession evolves, the CPA Exam must do the same. The exam remains relevant equally a measure of the cognition and skills newly licensed CPAs must have in social club to do their profession and protect the public interest efficiently and finer.

The UWorld Roger CPA Review form is rooted in the AICPA CPA Exam Blueprints, which is the framework for all the examination content. Our expert educational team consists of practicing CPAs and accounting educators who are dedicated to ensuring students are thoroughly prepared for success on the nearly up-to-engagement information.

We encourage candidates to effort UWorld Roger CPA Review for 7-Days free. This includes access to the highest-quality practise CPA Exam questions, the industry's most dynamic lectures, and our signature SmartPath Predictive Engineering. Plus, all class aspects are also available on our fully-featured mobile application.

Take your vii-Mean solar day Trial Now!

2022 CPA Test Changes

There are no content updates for BEC or FAR for the 2022 CPA Test. Changes to AUD and REG are outlined below.

AUD

The quick summary of changes to AUD for 2022 are:

- SASs No. 134 – 140 primarily deal with updates to the audit report for not-public companies and amendments to align other sections of the audit standards accordingly.

- SSARS No. 25, Materiality in a Review of Financial Statements and Adverse Conclusions, changes some of the rules applicative for reviews under the Statements on Standards for Accounting and Review Services.

Detailed View of Changes

SAS No. 134, Auditor Reporting and Amendments, Including Amendments Addressing Disclosures in the Audit of Fiscal Statements, revises:

- The sample engagement alphabetic character

- The audit report for nonissuers. Various changes include:

- Reordering the study to be similar to a PCAOB audit report, which starts with the auditor's opinion and is followed by the footing for opinion department

- Requiring a separate section in the report when substantial doubt about the entity'due south ability to proceed as a going concern exists

- Expanding the accountant's responsibility section of the report

- Communicating fundamental audit matters (KAMs) in the written report (in a divide section) when the auditor is engaged to do so

SAS No. 135, Autobus Statement on Auditing Standards, includes:

- Additional inquiries of the predecessor auditor regarding related party relationships/transactions and pregnant unusual transactions

- An additional enquiry of direction and others regarding significant unusual transactions

- Boosted examples of fraud gamble factors

- Additional procedures to perform with respect to related parties

SAS No. 137, The Auditor'southward Responsibilities Relating to Other Information Included in Almanac Reports, clarifies:

- The auditor'south responsibilities with respect to other information included in an annual report

- The definition of an annual report for such purposes

SAS No. 138, Amendments to the Description of the Concept of Materiality, revises the definition of materiality.

SAS No. 139, Amendments to AU-C Sections 800, 805, and 810 to Incorporate Auditor Reporting Changes From SAS No. 134 updates the reporting requirements with regard to special purpose frameworks to align with the new audit report structure.

SAS No. 140, Amendments to AU-C Sections 725, 730, 930, 935, and 940 to Incorporate Auditor Reporting Changes From SAS Nos. 134 and 137 revises the reporting requirements for the following types of engagements to align with the new inspect report structure:

- GAAS integrated audits (ie, reporting on internal control in conjunction with a financial inspect)

- Reviews of acting financial information

- Government compliance audits

SAS No. 140, also requires split sections in the report for other data, supplemental information, and required supplemental data.

SAS No. 25, Materiality in a Review of Fiscal Statements and Adverse Conclusions:

- Requires the accountant to decide materiality for the financial statements as a whole, and design and perform review procedures to address all fabric items

- Permits the expression of an adverse conclusion in a review engagement

- Requires the review report to include a statement that the accountant is independent

REG

The REG section of the CPA Exam will run across the following temporary revenue enhancement provisions expire with 2021, and prior rules will become testable again:

Consolidated Appropriations Act items

- 100% charitable contributions limit for individuals

- 25% of ATI charitable contribution limit for corporations

American Rescue Programme Human activity (ARPA) items

- Increases in the Kid Tax Credit to $3,000 per child under age 18 and $3,600 per child under 6

- Increases in the Child and Dependent Intendance Credit to $4,000 for one kid and $8,000 for 2 or more

- An increase in the employer dependent care exclusion to $10,500

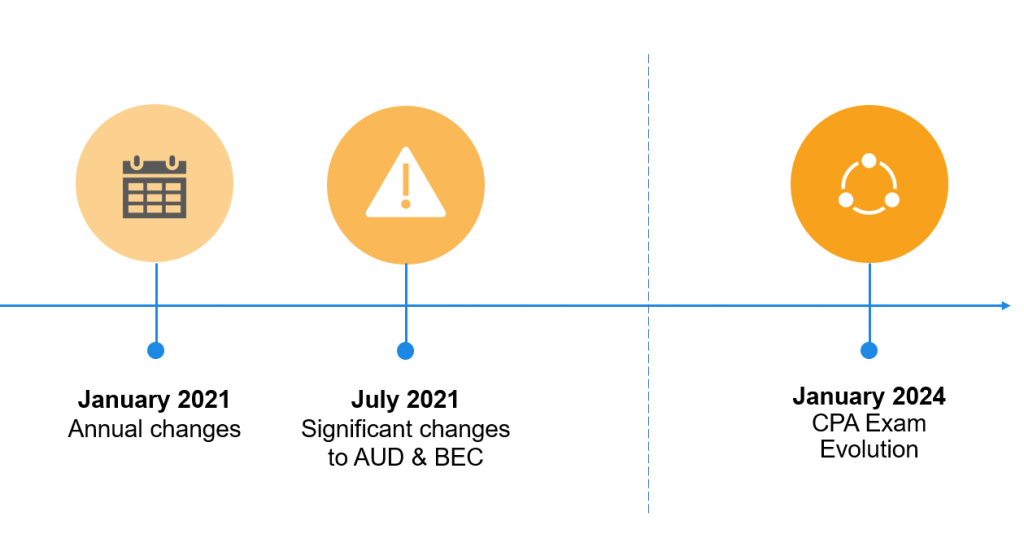

Timeline of CPA Exam Changes

Latest CPA Exam Information

2021 CPA Examination Changes

The fourth dimension is at present. Take the start step towards CPA Exam success!

As the accounting profession evolves, the CPA Exam must do the same. The exam remains relevant equally a measure of the knowledge and skills newly licensed CPAs must have in order to practice their profession and protect the public interest efficiently and effectively.

The UWorld Roger CPA Review course is rooted in the AICPA CPA Exam Blueprints, which is the framework for all the test content. Our expert educational team consists of practicing CPAs and accounting educators who are dedicated to ensuring students are thoroughly prepared for success on the most upwards-to-date data.

We encourage candidates to endeavour UWorld Roger CPA Review for 7-Days free. This includes admission to the highest-quality practice CPA Exam questions, the manufacture's most dynamic lectures, and our signature SmartPath Predictive Technology. Plus, all course aspects are also available on our fully-featured mobile application.

Have your vii-Day Trial At present!

October 2021 CPA Exam Changes

AUD

- Updated for SSAE No. 19, Agreed-Upon Procedures Engagements

- SSAE No. xix's near notable changes include:

- Eliminates the requirement to go an assertion from the responsible party

- Allows the practitioner to assist in developing the procedures equally long as the engaging party acknowledges the ceremoniousness of the procedures prior to the issuance of the report

- Allows the procedures to exist developed over the course of the engagement

- Eliminates the requirement for intended users to accept responsibility for the sufficiency of the agreed-upon procedures

- Allows a general-use report to be issued

- SSAE No. xix's near notable changes include:

FAR

- Updated for ASU 2021-03, Intangibles—Goodwill and Other (Topic 350): Accounting Culling for Evaluating Triggering Events

- ASU 2021-03 provides an additional bookkeeping alternative to assistance simplify and reduce the price of goodwill accounting for private and not-for-profit entities. Under this new culling, they can perform the required triggering event evaluation to examination for impairment as of the stop of the reporting period, rather than having to monitor for triggering events and performing such evaluations throughout the reporting menstruation.

REG

- Updated for American Rescue Plan Act (ARPA)

- ARPA has various minor changes that could be testable on the test, such as:

- Increasing the Child Tax Credit to $iii,000 per child under historic period 18 and $3,600 per child under half-dozen*

- Increasing the Earned Income Credit limit for investment income to $10,000

- Increasing the Child and Dependent Care Credit to $iv,000 for one kid and $8,000 for two or more*

- Increasing the employer dependent care exclusion to $10,500*

- Expanding the exclusion for discharge of indebtedness to encompass qualified student loans

- ARPA has various minor changes that could be testable on the test, such as:

*Notation that some of these items are testable simply from x/1/2021 to 12/31/2021.

July 2021

AUD & BEC

- Increased emphasis on:

- Understanding automated business processes and the related risks and controls,

- The importance of having a digital and data-driven mindset besides as the use of data analytics, and

- System and System Controls reports on controls over financial reporting at a service organization (ie, SOC 1 reports).

Download our 2021 CPA Exam Changes Infographic.

Download our 2021 CPA Test Changes Infographic. Acquire more than about what to expect on the exam in 2021.

January 2021

There are only minor changes to the CPA Exam for January 2021. More robust changes were originally expected, simply they have been delayed due to the pandemic.

REG

- Removal of most CARES Act changes

- Exam Topic: Individual and Corporate Taxation

FAR

- ASU 2018-14—Compensation—Retirement Benefits—Divers Benefit Plans—General (Subtopic 715-20): Disclosure Framework—Changes to the Disclosure Requirements for Defined Benefit Plans

- ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes

A Sampling of Changes Coming to the CPA Exam

Topics to be Expanded on the Exam

Digital and Information-Driven Mindset and Other Technological Impacts

- AUD

- Business processes and internal controls

- Utilize of SOC 1 reports

- IT organization infrastructure

- Data flows

- Effect of general and application controls on the abyss and reliability of data

- Utilize of automatic tools and data analytics in the audit

- Skepticism and judgment in analyzing data

- Business processes and internal controls

- BEC

- Business processes and internal controls

- Understanding the importance of SOC 1 reports for outsourced IT functions

- Utilise of data and business intelligence

- Data governance

- Data management

- Data relationships

- Working with data (extraction, transformation, and loading)

- Business processes and internal controls

Topics to be Removed from the Exam

- IFRS (FAR)

- Manor Tax (REG)

Changes in Content and Skill Weighting on July 1, 2021 Blueprints

- AUD

- Content Weighting

- Area II, Risk Assessment and Planning, increased by 5%

- Area Iv, Reporting, decreased by 5%

- Skills Weighting

- Shifting from Remembering & Understanding to Analysis by 5%

- Content Weighting

- BEC

- Content Weighting

- Area I, Corporate Governance, increased by 3%

- Area II, Economics, decreased by 2%

- Area III, Financial Management, decreased by ane%

- Skills Weighting

- No alter

- Content Weighting

- No weighting changes for FAR and REG

2020 CPA Exam Changes

As of July 1, 2020, in that location were changes to both the REG (Regulation) and BEC (Business concern Environs and Concepts) sections of the CPA Exam. The July 1st updates independent the following revisions:

October 2020

FAR

- CARES Human activity (Coronavirus Aid, Relief, and Economical Security)

- Examination Topic: Accounting for Income Taxes (Cyberspace Operating Losses)

- Change in Definition of Accelerated Filer & Nonaccelerated Filer

- Exam Topic: Reporting the Results of Operations (SEC Reporting Requirements)

REG

- CARES Act (currently only applicable for Q4 of 2020)

- Exam Topic: Private and Corporate Taxation

- Modify in Definition of Accelerated Filer & Nonaccelerated Filer

- Exam Topic: Federal Securities Regulations

FAR Changes on the 2020 CPA Exam

As of January 1, 2020, in that location have been major changes to the FAR exam, specifically surrounding Financial Instruments – Credit Losses. These changes are quite pervasive and complicated, every bit they apply to most financial avails and crave the utilise of more than judgment and diverse factors in developing expectations of credit losses.

Financial Instruments – Credit Losses (ASUs 2016-13, 2018-xix, 2019-05) — The credit loss (ie, bad debt) changes are pervasive and complicated. These changes remove more than vivid-line rules that accountants are used to and require more than judgment, and in some cases information analytics, to develop expectations for credit losses. Here's some of the nuts:

- This represents a switch from anincurred credit loss model to a current expected credit loss (CECL) model to reflect economic downturns in the financial statements faster (ie, earlier recognition).

- The new model estimates expected credit losses over the lifetime of the asset for more than credit take a chance transparency.

- Estimates tin be based on historical information, electric current conditions or reasonable and supportable forecasts (eg, predictive data analytics).

- The new guidance applies to avails measured at amortized cost (eg, receivables and held-to-maturity debt securities) and available-for-auction (AFS) debt securities, as well equally finance leases and off-balance-sheet credit exposures (eg, fiscal guarantees).

- When expected credit losses increase, an assart for credit losses (ie, a contra-business relationship) is booked at the reporting engagement to suit the value of the asset, and credit loss expense is recognized on the income statement.

- When expected credit losses subtract, the assart for credit losses is decreased, and a credit loss expense is reversed on the income statement.

- Such assets are written off when they are entirely uncollectible.

Goodwill (ASU 2017-04)

The second stride in the goodwill damage test (ie, calculating the implied fair value of goodwill) has been eliminated for simplification purposes.Now you basically just compare the fair value of the reporting unit with its carrying value. If fair value is less than carrying value, then goodwill is impaired and a loss should be recognized.

- Aligns the accounting treatment of implementation costs incurred in a deject computing arrangement that is treated every bit a service contract with the requirements to capitalize implementation costs incurred with respect to internal-use software.

- Expands the private company accounting alternative for variable interest entities (VIEs) to provide an electionnot to apply the regular VIE GAAP guidance when sure criteria are met.

- Statement No. 87 provides a single model for charter accounting (ie, all leases are substantially finance leases, with limited exceptions).

- Statement No. 89 provides clarification on accounting for involvement price incurred before the finish of a construction menstruum.

- Intangibles (ASU 2018-15)

- Variable interest entities (ASU 2018-17)

- GASB Updates

Further Breakdown of FAR 2020 CPA Examination Changes

Expected Credit Loss Model (ASC 326-twenty)

What assets will be affected past this change?

- Accounts receivable (A/R), financing receivables, finance leases, held-to-maturity (HTM) debt securities, available-for-sale (AFS) debt securities, and other off-balance sail credit exposures (eg, financial guarantees).

How is each type of nugget afflicted by the change?

- A/R, HTM debt securities, & finance leases:

- Estimate losses over life of asset with pools of avails that accept similar take a chance profile assumptions to capture hazard, even if the risk is remote.

- Direction should have a reasonable forecast of economic weather condition and documentation to support this.

- For assets that are purchased having a significant credit deterioration since issuance, an assart needs to be recorded at acquisition.

- Significant new disclosures will be required in statements.

- AFS debt securities:

- No longer consider the length of time an instrument has been impaired in model.

- Tape an allowance for credit losses instead of a reduction in amortized cost basis.

- Limit credit losses to excess of amortized cost over fair value.

- Reduce allowance for credit risk improvements and reverse credit loss expense in the income statement.

How will it affect the financial statements?

- Credit losses are recognized earlier than they would have been under current GAAP.

- Income becomes more volatile as credit loss expense is recognized.

- More processes and controls need to be implemented past management to consistently pool avails and make up one's mind atmospheric condition that touch their model. Even if management doesn't await the allowance to change significantly, they need to have a repeatable and understandable procedure to how they came to that conclusion. Documentation in the notes to financials volition exist required.

- More data will demand to exist collected and included in the model to help direction decide how to identify information that tin be used in developing the reasonable and supportable forecast, whether internal or external, to guess the expected credit losses.

What are the central differences between the former incurred loss model and the new expected credit loss model?

- Instead of reporting losses that have been incurred as of the remainder canvass appointment, credit loss expense is now recognized for credit losses that are expected over the life of the asset. Since this recognition of losses will now period through the income statement, earnings will likely get more volatile.

- Pooling of assets that share a common risk profile is required with the new model, whereas current GAAP permits merely doesn't require this. Management discretion on what assets to puddle together comes into play. This also means that where a single asset may not accept had any expected credit losses, the puddle of similar avails could.

- Economical weather are considered in both electric current GAAP and the new model. The new model also includes management's expectations of hereafter economic conditions. This is another area where more than judgment is required.

- The result of the new model should show up on the residual sheet as what management thinks is the internet amount that volition be nerveless on the asset.

Implementation considerations for the expected credit loss model:

- Components of amortized toll include unpaid principal balance, accrued interest, unamortized discounts / premiums, foreign exchange adjustments, and fair value hedge accounting adjustments.

- Limited historical loss information may be available for amortized toll other than unpaid chief balance.

- Processes and controls volition need to be adult for gathering data for the components of amortized cost that haven't been historically captured.

- Pools of similar avails based on take chances profile will need to be reviewed at each measurement date to confirm they still share gamble attributes and belong to the same pool. This review and any changes will need to exist documented.

- Losses need to be reflected over the asset's contractual life.

- Included: expected prepayments and contractual extensions.

- Excluded: expected extensions, renewals and modifications.

- It may be hard to determine contractual life on assets that have no stated maturity like A/R and credit menu receivables. Management volition also need to determine if a loan refinance with the aforementioned lender would exist considered a prepayment.

- Management judgment will be required to determine:

- The method that is virtually appropriate for determining credit losses. A variety of methods may be used, including the discounted greenbacks flow method, loss-rate methods, roll-rate methods, probability-of-default method, and crumbling schedules.

- Designation of pools of assets with similar gamble profiles. Chance of default is understandable merely may likewise include specific nugget risks for the visitor or the company's appetite for more than or less risk based on its individual tolerance.

- Key economic variables used in model.

- Selection of reasonable and supportable forecast period.

- Determination of how to select the estimate used—is it a single most likely upshot or a weighted average outcome based on probability?

- Support adjustments to historical loss information and reversion methodology to the historical loss model past the reasonable and supportable forecast menstruum of the expected loss model.

- Is it worth managing all this information or can an external source of data be used?

Reference article:https://www.ey.com/publication/vwluassetsdld/technicalline_04486-181us_creditlosses_4october2018/$file/technicalline_04486-181us_creditlosses_4october2018.pdf?OpenElement

Goodwill (ASU 2017-04)

- The only step in determining goodwill harm will exist the current 1st stride of the impairment determination: comparing the fair value of a reporting unit with the carrying amount. If the toll is greater than off-white value, the goodwill damage charge equals the difference up to the amount of goodwill allocated.

- The primary goal of the standard is simplification and providing cost savings to all entities.

- Any loss recognized should not exceed the full amount of goodwill allocated to that reporting unit of measurement.

- Impairment losses on goodwill can't be reversed once recognized.

Reference article: https://world wide web.bdo.com/insights/assurance/fasb/fasb-flash-report-feb-2017-(1)

Intangibles (ASU 2018-15)

The point of this guidance is to reduce variety in exercise for the costs of implementing deject computing arrangements or hosting arrangements that are service contracts. Entities that historically capitalized implementation costs for internal use software projects should apply their existing policies and procedures to implementation costs incurred in hosting arrangements that are service contracts.

Customers should utilise ASC 350-forty to determine whether to capitalize implementation costs of the deject computing arrangement or expense them as incurred.

- Only qualifying costs incurred during application development stage tin can exist capitalized. Examples: costs of integrating the hosting arrangement with software on site, coding, configuring, customization, compensation and benefits for employees for time spent on application development activities, and interest costs incurred while implementing the hosting arrangement.

- Other costs are required to be expensed like costs of project planning, training, maintenance after implementation, and data conversion. Overhead costs (general and authoritative) and grooming costs non related to software development or implementing the hosting organisation can't exist capitalized.

- For multiple element arrangements like training, hosting, maintenance, information conversion, etc. arranged together, companies need to allocate the costs to each element on the relative standalone cost for each part of the contract.

- Companies implementing hosting arrangements with multiple modules should accumulate costs and amortization records at the module level so that they tin can brainstorm amortization at the appropriate time for that module. Documentation of modules, costs, obsolesce, and impairment or abandonment are required.

Reference articlehttps://www.ey.com/publication/vwluassetsdld/technicalline_04271-181us_cloudcomputing_6september2018/$file/technicalline_04271-181us_cloudcomputing_6september2018.pdf?OpenElement

Variable interest entities (ASU 2018-17)

This standard applies to all entities except for public entities, non-for-profit entities, and employee do good plans qualifying mutual control arrangements. It creates an alternative accounting policy election to not apply VIE guidance to legal entities under common control. All the following criteria must be met for this election:

- Reporting entity and legal entity are under mutual control.

- Reporting entity and legal entity are not under mutual command of a public entity.

- Legal entity under common control is not a public entity.

- Reporting entity doesn't have a direct or indirect controlling financial interest in the legal entity.

Additional disclosures are required related to the reporting entity'due south involvement and exposure to entities with this election. While it doesn't require consolidation, a combined financial statement presentation is nonetheless an option to show combined results for entities under common control. Early on adoption is immune, and entities are required to use the amendments retrospectively.

Reference commodity: https://world wide web.cohencpa.com/insights/articles/asu-2018-17-a-private-company-accounting

GASB Statement No. 87

The rule change volition make GASB lease accounting like to FASB lease accounting where essentially all leases will be required to exist reported on the residuum sail. Distinctions between operating and finance leases, even so, are eliminated.

For Lessees:

- Lease liabilities will exist considered long-term debt.

- Charter payments will be financing outflows on the cash flow statement.

- For operating-type leases, hire expense will no longer be reported in the activity statement. Instead, interest expense on the liability and acquittal expense related to the asset volition be reported.

For Lessors:

- Lessor accounting will mirror lessee accounting—this is different from FASB and IASB.

- Lessor will recognize a lease receivable and a corresponding deferred inflow while still reporting the asset underlying the lease.

- Interest income from the receivable volition be recognized using the effective interest method.

- Charter revenue will exist recognized through amortizing the deferred inflow over the lease term.

- New rules exclude leases associated with investment avails carried at fair value like investment rental property. This accounting doesn't change from current treatment.

GASB vs. FASB Differences

- Right-of-employ assets may amortize more quickly than liabilities in GASB, which volition negatively impact internet position. FASB'southward treatment has the nugget and liability at roughly the same amount.

- FASB reports charter liabilities as long-term operating payables. GASB has them as long-term debt. This could impact compliance with debt covenants.

- FASB reports directly-line rent expense, and GASB reports interest expense on the liability and acquittal expense on the asset. This speeds up expense recognition.

- Statement of cash flows: GASB – capital financing outflows / FASB – operating outflows.

Reference commodity: https://www.pwc.com/u.s.a./en/cfodirect/publications/in-brief/gasb-lease-accounting-rules.html

GASB Argument No. 89

This argument requires state and local regime agencies, including public housing government, to expense interest during the construction period instead of capitalizing the involvement and including information technology in the asset's value. The change was made to simplify reporting and show the true cost of borrowing. The do good of expensing interest has an immediate impact on the income statement instead of amortizing over several years.

Reference article: https://world wide web.bdo.com/insights/business organisation-financial-advisory/pha-finance/%E2%80%8Bgasb-statement-89-accounting-for-involvement-costs

2021 CPA Test Changes Q & A

If you buy a Roger CPA Exam review course now, you lot volition accept access to a fully upgraded course platform once the 2021 CPA Exam changes become into effect in January 2021. All Roger CPA Review students volition receive automatic updates to their online course materials for the elapsing of their form.

Exam content tests the skills that newly licensed CPAs must know to continue to protect the public interest, including:

- Disquisitional thinking, problem solving, analytical ability, and professional skepticism

- Constructive communication skills

- Well-developed enquiry skills

- A strong understanding of the business environment and processes

- Ethics and professional responsibilities

2019 CPA Exam Changes

Play Video

Video Transcript

Hello and welcome. My name is Roger Philipp of Roger CPA Review. Today I wanna talk virtually the top two changes to the CPA Exam in 2019.

Nosotros've been working hard to ensure that our 2019 course materials reflect the updates to the CPA Exam provided to us by the AICPA. While in that location are non structural changes on the exam, at that place are major content changes happening on the FAR and REG exams that are going into consequence January 1st, 2019.

In Financial, Accounting, and Reporting, or in FAR, the big surface area that changed is leases. In 2016, the FASB issued ASC 842, which updated the accounting treatment of the leases. The goal was to provide more transparency and comparability amid companies regarding lease assets and liabilities. To help ensure the transition, the Board allowed entities to prefer both the new lease standard and it wasn't gonna hit the exam or isn't until Jan 2019, which is now quickly approaching. Some of the changes include balance sheet recognition. Operating leases lasting over 12 months now must be reported on the residue sheet. And then before we had what we called an off-residuum sail risk, now they have to be listed in the balance canvas. The new standard creates transparency for investors regarding a visitor'southward financial leverage and earnings. With financial statement disclosures, ASC 842 has much more stringent disclosure requirements for both quantitative and qualitative financial statement disclosures. The increased requirements may require companies to improve or implement new systems, procedures, and controls to provide the required disclosure. Lease qualification, long-term leases are now reported on the balance sail. Short-term leases of 12 months or less are still immune to exist excluded from the balance sheet, but yous could include them if you lot and then desire. The new standard dictates that if the lessee does not accept the right to command the employ of the asset, then the transaction may not qualify equally a lease. And so that deals with command, and then you lot've got to have the control. With lease payments at that place is a new revised definition of indirect costs resulting in fewer allowed capitalized costs. Executory costs, like holding taxes, insurance, will now be included in lease payments. Regarding a sale leaseback transaction, so you sell information technology and and then you immediately charter information technology dorsum, to authorize as a sale, the transfer of the nugget must adhere to the acquirement recognition requirements in ASC 606, which deals with acquirement from customers with contracts. When the transaction does non qualify as a sale, it is classified as a financing transaction, then kinda like you borrow the money in more of what nosotros call a note payable.

And so what does all of this hateful for yous? Well, since several brilliant-line tests have been removed, the update likewise requires that more judgment exist applied. Because we used to have these 4 criteria for a capital lease, now we call information technology a finance lease. At present at that place's v criteria. Things like specialized nature, a purchase option, championship transfer, but here is an area where it kinda got a little greyness. The term, it says it has to be a major part of the lease, used to say 75%. Payment, substantially all, which used to be 90% of the fair market place value. And so that's where the bright-line tests kinda come up in. So what yous're gonna see is you're gonna need more than of what we call brain power when addressing these questions on the CPA Test once these changes get into effect on January 1st, 2019.

Now let'south talk a little scrap about regulation changes, particularly in the surface area of taxation. This is probably the biggest change that everyone is talking about to the CPA Exam, particularly in Regulation. And this is due to what we call the TCJA, which is the Tax Cut Job Acts of 2017. This significantly changed and updated the tax lawmaking, which impacts all the sections of tax, which accounts for most as up to 85% of the Regulation test. This is the section nosotros highly recommend that you take this year in 2018, as information technology volition crave yous to relearn all that not bad stuff that you studied in school near taxes, whether information technology was in academy or whether yous've been working in the existent earth, it'll all change.

Here are some, only a few of the examples of the changes.

- There's an increment in the Section 179 deduction. And then we talk about deductions for depreciation and bonus depreciation. Used to be almost half a million, now it went up to a 1000000, starts to phase out at $2.five 1000000.

- Increased standard deduction, but the elimination of the personal exemption. And then no more than personal exemption, dependency exemptions, but your standard deduction is $12,000. Married, filing joint, double or $24,000. Might exist a good reason to get married.

- New limitations on holding and state taxes, as well equally local taxes and as well mortgage involvement. So your belongings and state revenue enhancement and all those are limited to $10,000 max. Your mortgage interest used to be a million one. They dropped it downward to $750,000.

- In that location's also a new deduction of up to 20% for owners of sure laissez passer-through entities, similar S-corps, partnerships, and and then on. It'southward called a QBI deduction, or a Qualified Business organization Income Deduction, which is really nice.

- If we increase the charitable contribution, so if yous donate cash, you could instead of 50% of AGI, they increased it to 60% of AGI.

- Entertainment expenses are now disallowed. So we used to do meals and entertainment. Now it'due south merely meals, no more entertainment.

- The new corporate tax rate, a flat revenue enhancement charge per unit, it went from 35% down to 21%, which is helpful. And that whole purpose was to bring corporations back in the United States. Increased gross receipts test, which allows more entities now to utilize the cash basis or cash method of bookkeeping. Used to be at $10 million, they increased to $25 million.

And so in conclusion, you can run into that the CPA Exam content updates to these two areas will be significant. If you need help working these exams into your busy schedule, our new SmartPath Predictive Applied science is the nigh effective way to maximize your study time. Well, information technology's a data-driven platform that tells you exactly where and how to focus your efforts. It takes the guesswork out of CPA Test preparation. It's helping candidates pass the test faster than ever before. They're more effective, they're more efficient. No affair when you determine to take the exam, we have your back and we'll guide y'all on the SmartPath to CPA Exam success.

Cheers and good luck in your studies.

Learn about the top 2 changes to the 2019 CPA Exam and how our patent pending SmartPath Predictive Engineering will help you pass faster than e'er before. We understand the importance of providing students with everything they demand to successfully prepare for and accept the CPA Exam. Our expert squad of CPAs worked difficult to ensure our 2019 course materials addressed the July 2019 CPA Exam changes that were eligible for testing on July ane, 2019. Our course was updated past June 11, 2019 to suit the July 1st revisions. The updates in our course software not only prepared students for the changes, merely too gave them the confidence and resources they needed on Exam day. See revisions below for each 2019 CPA Examination section.

2019 CPA Examination Changes past Role

Auditing and Testament (AUD)

Blueprints: The 2019 AUD Blueprints practice not include whatsoever additional or eliminated content areas. Still, there have been revisions to add more than item on professional person skepticism and Audit Data Analytics (ADAs). Notation that these updates practice not change the nature or scope of content eligible for testing.

- Added references to professional person skepticism in the department introduction:

- Professional person skepticism reflects an iterative process that includes a questioning listen and a critical cess of audit evidence. It is essential to the practice of public accounting and the work of newly licensed CPAs.

- Added a Topic in Surface area I, Group B titled "Professional skepticism and professional judgment" with the following remembering and understanding chore statements:

- Sympathise the concepts of professional skepticism and professional judgment.

- Understand personal bias and other impediments to acting with professional person skepticism, such as threats, incentives and judgment-making shortcuts.

- Added an assay representative task argument in Area Three, Group A – Performing Further Procedures and Obtaining Prove - Agreement sufficient advisable evidence, equally follows:

- Investigate prove that either contradicts or corroborates management explanations, expectations and other hypotheses throughout an inspect or non-audit engagement.

- Revised the analysis representative task argument in Area Three, Group C, Topic three – Performing Further Procedures and Obtaining Testify – Performing specific procedures to obtain show - Inquiry of management and others, as follows:

- Analyze responses obtained during structured or informal interviews with management and others, including those in non-fiscal roles, and ask relevant and effective follow-upwards questions to understand their perspectives and motivations in an audit or non-audit appointment.

- Added an analysis representative task statement in Area Iii, Group C, Topic 6 – Performing Farther Procedures and Obtaining Bear witness – Performing specific procedures to obtain evidence - All other procedures, as follows:

- Modify planned procedures based upon new information, such as inconsistent explanations, new testify and environmental cues, to reach inspect objectives in an audit of an issuer or a nonissuer.

- Revised the tertiary bullet under the Area 2 description:

- Assessing Risks and Planning Further Procedures — Identifying and assessing risks of misstatement due to error or fraud and developing appropriate date procedures, including understanding and calculating materiality and considering specific date risks, as well equally incorporating concepts such equally inspect information analytics, group audits, using the work of the internal audit function and the piece of work of specialists.

- Revised the 1st sentence in the description of Surface area III:

- Area III of the AUD section blueprint covers performing date procedures and concluding on the sufficiency and ceremoniousness of testify obtained, including performing specific types of procedures (e.g., analytical procedures, analytical procedures using audit data analytics, observation and inspection, recalculation and reperformance); testing the operating effectiveness of internal controls; performing tests of compliance and agreed-upon procedures; agreement and responding to specific matters that require special consideration (east.thou., accounting estimates, including fair value estimates); evaluating and responding to misstatements due to error or fraud and to internal command deficiencies; obtaining direction representations; and performing procedures to identify and respond to subsequent events and later on discovered facts.

- Revised the awarding representative task statements in Surface area Two, C, 4:

- Identify and certificate an entity'southward central It general and application controls, their bear upon on the audit of an entity'southward financial statements, including an audit of an entity's internal controls, and consider the issue of these controls and manual controls on the completeness and reliability of an entity's data.

- Perform and document tests of an entity'south key IT full general and awarding controls, their impact on the audit of an entity's fiscal statements, including an inspect of an entity'southward internal controls, and consider the effect of these controls and manual controls on the completeness and reliability of an entity's data.

- Added an assay representative task statement in Area II, E, iii:

- Assess risks of material misstatement using audit data analytic outputs (e.thou., reports and visualizations) to determine relationships among variables and translate results to provide a footing for developing planned inspect procedures.

- Added an analysis representative task argument in Surface area III, C, i:

- Perform belittling procedures using outputs from audit data analytic techniques to determine relationships among variables and interpret results in an inspect or not-audit date.

- Added ii assay representative task statements in Surface area III, C, 6:

- Determine the attributes, structure and sources of data needed to complete audit data analytic procedures.

- Apply inspect data analytic outputs to make up one's mind relationships amid variables and interpret results to run into objectives of planned procedures in an audit or non-audit date.

Content: The AUD department of the Exam volition see some slight adjustments in content for 2019, including:

- PCAOB release 2017-001, The Auditor's Report on an Audit of Financial Statements when the Auditor Expresses an Unqualified Opinion and Related Amendments to PCAOB Standards—Eligible for testing Q3 2018 (except for disquisitional audit matters, which is eligible for testing in Q3 of 2019).

- SSARS No. 24, Charabanc Argument on Standards for Bookkeeping and Review Services —2018—Eligible for testing in Q3 2019.

- Government Auditing Standards—2018 Revision (Yellow Volume)—Updates related to performance audits are eligible for testing in Q3 of 2019 (Updates related to financial audits, attestation engagements, and reviews of financial statements are eligible for testing in Q3 of 2020).

Business Environment and Concepts (BEC)

Blueprints: At that place have been revisions to the July 2019 BEC Blueprints to add clarification and reorganize the cloth. However, the revisions do not significantly change the content eligible for testing. More than specifically, these changes:

- Clarify the Section introduction past:

- Replacing the description of Area I with the following:

- Area I of the BEC section design covers several topics related to Corporate Governance, including the following:

- Knowledge and use of internal command frameworks

- Knowledge and use of enterprise risk management frameworks

- Identifying key corporate governance provisions of regulatory frameworks and laws such as the Sarbanes-Oxley Act of 2002

- Area I of the BEC section design covers several topics related to Corporate Governance, including the following:

- Replacing the description of Surface area IV with the following:

- Area Four of the BEC department design covers several topics related to Information Technology (IT), including the following:

- Understanding the role of It and systems, including the employ of data in supporting business decisions.

- Identifying IT-related risks associated with an entity'south information systems and processes, such every bit processing integrity, protection of information and organization availability, including those risks introduced past the relationships with third-parties.

- Identifying application and IT full general control activities, whether transmission, It dependent or automated, that are responsive to It-related risks, such equally access and authorization controls, system implementation testing and incident response plans.

- Calculation a reference:

- COSO-issued application material, idea papers and guides related to the above frameworks

- Area Four of the BEC department design covers several topics related to Information Technology (IT), including the following:

- Replacing the description of Area I with the following:

- Reorganize Surface area IV, Information Technology, to clarify the nature and scope of content. The following representative tasks have been revised as follows:

- Area 4, A, one – Agreement of information technology (IT) – Organization and governance: Identify the function of data systems (east.g., enterprise and application systems) in cardinal business processes (eastward.g., sales, cash collections, purchasing, disbursements, human being resources, payroll, production, treasury, fixed avails, general ledger and reporting).

- Area Four, A, 3 – Agreement of information technology (IT) – Information:

- Understand primal characteristics of a relational database (e.1000., information dictionary, information types, tables, records, fields, relationships, keys, views, queries and reports).

- Recognize the role of big information in supporting business decisions.

- Surface area Four, A, 3 – Agreement of information technology (IT) – Data: Use business intelligence (including data analytics and statistics) to support business organisation decisions.

- Area IV, B, i – Risks associated with Information technology - Risk assessment: Identify IT-related risks and depict mitigation strategies given gamble severity, probability and costs.

- Area Iv, B, 2 – Risks associated with IT - Arrangement development and maintenance: Determine the primal problems and risks associated with selecting, developing and implementing new information systems or maintaining existing information systems.

- Area Four, Group B, Topic 3 – Risks associated with IT - Processing integrity: Determine the risks associated with ensuring the completeness, accuracy and continued processing integrity in input, storage, processing and output processes.

- Area 4, Group B, Topic 3 – Risks associated with IT - Processing integrity: Determine the risks associated with ensuring the abyss, accuracy and continued processing integrity in input, storage, processing and output processes.

- Area Iv, B, 4 – Risks associated with It - Security, availability, confidentiality and privacy:

- Identify the risks (e.1000., cybersecurity and internal) associated with protecting sensitive and critical information (due east.g., proprietary and personal information) within information systems (including processing, storing and transmitting information internally and with external parties).

- Perform threat identification to identify risks related to information confidentiality.

- Area IV, B, iv – Risks associated with IT - Security, availability, confidentiality and privacy: Perform threat identification to identify risks related to system availability.

- Area IV, C, one – Controls that answer to risks associated with IT – Awarding controls: Determine the role and appropriateness of input, storage, processing, and output application controls (eastward.g., authorizations, approvals, tolerance levels, input edits and configurations) to support completeness, accuracy and continued processing integrity.

- Area IV, C, ii – Controls that respond to risks associated with Information technology - General IT controls:

- Understand the controls and testing strategies used in selecting, developing and implementing new data systems.

- Identify effective IT command activities, including manual, IT dependent and automated controls, as well equally preventive, detective and corrective controls.

- Expanse IV, C, 3 – Controls that reply to risks associated with Information technology - Logical and physical controls: Place logical and physical access controls (e.chiliad., roles and rights and segregation of duties).

- Area 4, C, 3 – Controls that answer to risks associated with It - Logical and physical controls:

- Identify the controls associated with protecting sensitive and disquisitional information (east.k., proprietary and personal) within information systems.

- Determine responses to information system confidentiality risks (east.g., incident response plan).

- Area IV, C, iv – Controls that respond to risks associated with IT - Continuity and recovery plans: Decide responses to arrangement availability risks (e.g., data fill-in and recovery procedures and alternate processing facilities).

Content: At that place are no new content updates to BEC for 2019.

Financial Accounting and Reporting (FAR)

Blueprints: The FAR Blueprints have ane change in response to ASU 2016-14: Presentation of Financial Statements of Not-for-Profit Entities (eligible for testing on Jan one, 2019).

- Added a Topic titled "Notes to the financial statements" to Expanse I, C – Conceptual Framework, Standard-Setting and Financial Reporting - Full general-purpose fiscal statements: nongovernmental, not-for-profit entities with the following application task statement:

- Adapt the notes to the financial statements to correct identified errors and omissions.

Content: The most prominent alter to the FAR Examination in 2019 is to the highly tested topic, Leases (ASU 2016-02, 2018-01, 2018-ten, 2018-11, 2018-20 and IFRS sixteen). You've probably already heard about information technology since the standards have been out since 2016, but merely in case y'all haven't, y'all might like to know that "off-balance sheet financing" has been eliminated. Operating leases must now be recognized by the lessee on the rest sheet (except for curt-term leases of 12 months or less). Previously, merely uppercase leases (now called "finance leases") were recognized on the balance canvass. It'due south important to note that IFRS 16 is slightly different in that it essentially considers all leases to be finance leases unless they are worth $5,000 or less.

You might also annotation that several bright-line tests take been removed and more judgment is now required, making the standard slightly more than difficult to utilize. For example, there is no more "bargain purchase option" for purposes of determining whether a lease is a finance charter. A purchase choice must at present exist "reasonably certain to be exercised"; i.e., it no longer really matters whether it is a deal or not.

In add-on to this major lease accounting makeover, there are a few other small modifications that are testable in 2019:

- ASU 2017-06: Programme Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Primary Trust Reporting

- ASU 2017-08: Receivables—Nonrefundable Fees and Other Costs (Subtopic 310-twenty), Premium Amortization on Purchased Callable Debt Securities

- ASU 2017-11: Earnings Per Share (Topic 260), Distinguishing Liabilities from Equity (Topic 480), Derivatives and Hedging (Topic 815): I–Accounting for Certain Financial Instruments with Downwards Circular Features, II–Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Sure Mandatorily Redeemable Noncontrolling Interests with a Scope Exception

- ASU 2017-12: Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities

- ASU 2018-02: Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income

- ASU 2018-03: Technical Corrections and Improvements to Financial Instruments—Overall (Subtopic 825-ten): Recognition and Measurement of Financial Assets and Financial Liabilities

- ASU 2018-04: Investments—Debt Securities (Topic 320) and Regulated Operations (Topic 980): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Message No. 117 and SEC Release No. 33-9273

- ASU 2018-05: Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118

- ASU 2018-07: Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting

- ASU 2018-08: Non-For-Profit Entities (Topic 958): Clarifying the Telescopic and the Bookkeeping Guidance for Contributions Received and Contributions Made

- ASU 2018-09: Codification Improvements—Eligible for testing in Q2 of 2019

GASB Updates:

- Statement No. 84 – Fiduciary Activities

- Statement No. 88 – Certain Disclosures Related to Debt, including Direct Borrowings and Directly Placements

Regulation (REG)

Blueprints: The revisions made to the REG Pattern in January of 2019 were to accommodate tax reform. The mid-yr Design changes merely provide description and do not change the nature and scope of content eligible for testing.

- Revised existing analysis task statement in Area III, Group B - Federal Taxation of Property Transactions - Cost recovery (depreciation, depletion and amortization) to read as follows:

- Compare the tax benefits of the different expensing options for tax depreciation for federal income tax purposes.

- Added an application representative job statement in Surface area IV, Group C – Federal Tax of Individuals (including revenue enhancement preparation and planning strategies) - Adjustments and deductions to make it at adjusted gross income and taxable income, as follows:

- Calculate the qualifying business income (QBI) deduction for federal income taxation purposes.

- Removed reference to personal exemptions from Group F of Area IV, Federal Taxation of Individuals (including tax preparation and planning strategies) - Filing status and exemptions, deleted two job statements on personal exemptions, and added the post-obit remembering and understanding task statement:

- Call back relationships coming together the definition of dependent for purposes of determining taxpayer filing status.

- Removed references to alternative minimum tax for C Corporations and removed task statements focused solely on testing alternative minimum tax for C Corporations in Area V, Group C, Topic 1 – Federal Taxation of Entities (including tax preparation and planning strategies) - C Corporations - Computations of taxable income, revising existing task statements as follows:

- Calculate the credits allowable as a reduction of tax for a C corporation.

- Analyze the impact of internet operating and/or capital losses during tax planning for a C corporation.

- Added remembering and understanding representative task statements in Area V, Group C, Topic 5 – Federal Tax of Entities (including revenue enhancement preparation and planning strategies) - C Corporations - Multijurisdictional revenue enhancement issues (including consideration of local, state and international tax issues), as follows:

- Place situations where the base erosion and anti-corruption revenue enhancement (BEAT) would use.

- Identify factors that would qualify income as Foreign Derived Intangible Income (FDII).

- Define the components of Global Intangible Depression-Taxed Income (GILTI).

- Revised the 2nd application representative task statement in Area V, Group East, Topic 7 – Federal Revenue enhancement of Entities (including revenue enhancement preparation and planning strategies) - Partnerships - Buying changes, as follows:

- Calculate the revised basis of partnership assets due to a transfer of a partnership interest for federal income revenue enhancement purposes.

- Added to the Section introduction – The REG section of the Test includes multiple-option questions, task-based simulations and research prompts. Candidates should presume that the information provided in each question is textile and should apply all stated assumptions. To the extent a question addresses a topic that could have dissimilar revenue enhancement treatments based on timing (e.g., pension arrangements or internet operating losses), it will include a clear indication of the timing (due east.g., employ of real dates) so that the candidates can determine the advisable portions of the Internal Revenue Lawmaking or Treasury Regulations to apply to the question. Absent-minded such an indication of timing or other stated assumptions, candidates should assume that transactions or events referenced in the question occurred in the current year and should apply the most recent provisions of the taxation law in accordance with the timing specified in the CPA Test Policy on New Pronouncements.

- Surface area 3, A, 4 – Federal Revenue enhancement of Property Transactions - Acquisition and disposition of assets - Related party transactions (included imputed interests):

- Calculate the direct and indirect ownership percentages of corporation stock or partnership interests to determine whether there are related parties for federal income tax purposes.

- Area III, C, 3 – Federal Taxation of Property Transactions - Estate and souvenir taxation - Conclusion of taxable estate:

- Recall assets includible in a decedent's gross estate for federal estate taxation purposes.

- Recall allowable estate tax deductions for federal estate taxation purposes.

Content: Nearly of the 2019 REG Exam changes are due to revenue enhancement reform. The Taxation Cuts and Jobs Act of 2017 (TCJA) has impacted all tax sections, which can business relationship for as much as fourscore% of the REG Exam. To get an idea of how extensive the changes are, we have provided a Partial listing of some of the most important changes:

- P.Fifty. 115-97: An Human action to provide for reconciliation to titles II and V of the concurrent resolution on the budget for fiscal year 2018

- Commonly referred to as the "Tax Cuts and Jobs Act"

- Well-nigh pregnant overhaul of the U.S. tax code since the Tax Reform Act of 1986.

- Impacts individual tax, entity taxation (C corporations, S corporations, partnerships, limited liability companies, tax-exempt entities), and international taxation.

- Taxation of Property Transactions (Expanse III of Design—12-22%)

- Section 179 deduction increased.

- Definition of qualified real holding eligible for Sec. 179 expensing is expanded.

- Bonus depreciation is increased and expanded until existence phased out again starting in 2023.

- Required apply of 150% failing balance depreciation method is repealed.

- Straight-line recovery periods for qualified improvement property and residential rental property changed.

- Gross-receipts examination increased for purposes of UNICAP.

- New Section 1031 like-kind exchange limitations.

- Individual Taxation (Expanse IV of Blueprint— 15-25%)

- Increased standard deductions.

- No personal exemptions.

- Increased kid revenue enhancement credit and new "family tax credit" provision for other dependents.

- AMT exemptions increased.

- New limitation on land and local taxes.

- New mortgage interest limit.

- Home disinterestedness deduction disallowed, unless certain requirements are met.

- Pease limitation on overall itemized deductions suspended.

- New 20% deduction for owners of sure pass-through entities.

- Kiddie tax rates changed.

- Pension deduction/inclusion repealed, with exceptions.

- Moving expenses deduction/exclusion suspended for near.

- No prey losses deductions, with exceptions.

- 2% Misc. itemized deductions suspended.

- Taxation of qualified gains/dividends changed.

- New rules allowing limited distributions from 529 plans for elementary/secondary schoolhouse expenses.

- New exclusion for death/disability for student loan discharges.

- Expanded deductions allowed for wagering losses.

- Cash charitable contribution limitation increased.

- Most amusement expenses are disallowed.

- NOL carryback provisions were repealed; may carry NOLs frontward indefinitely.

- Entity Taxation (Area V of Blueprint—28-38%)

- Gross receipts test increased to allow more taxpayers to use cash method of bookkeeping.

- Inventories need non be accounted for under Section 471 if increased gross receipts test is met.

- Corporate graduated taxation rates reduced to flat 21% rate.

- Corporate AMT is repealed.

- New business interest deduction limitation.

- Deduction for qualified transportation fringe benefits generally no longer immune.

- Revised "covered employees" definition for purposes of limitation on bounty paid to such employees of public corporations.

- New limitation on accumulated earnings credit for certain controlled corporations.

- Dividends received deduction percentages reduced to reflect lower corporate income tax rates.

- Domestic product activities deduction is repealed.

- New international tax rules.

2019 CPA Exam Changes Q & A

If yous purchase a Roger CPA Exam review course at present, you will have admission to a fully upgraded course platform once the 2019 CPA Exam changes go into effect in January 2019. All Roger CPA Review students volition receive automatic updates to their online course materials for the duration of their course.

Exam content tests the skills that newly licensed CPAs must know to keep to protect the public involvement, including:

- Disquisitional thinking, problem solving, analytical ability, and professional skepticism

- Effective communication skills

- Well-developed research skills

- A stiff understanding of the business surroundings and processes

- Ethics and professional responsibilities

russellaftentonvere.blogspot.com

Source: https://accounting.uworld.com/cpa-review/cpa-exam/changes/

0 Response to "Per the Roger Cpa Exam Review What Does the Financial Reporting Framework Include?"

Post a Comment